The VA Loan is, as I’ve said before, Uncle Sam’s way of patting veterans like myself on the back for serving our country. Unfortunately, there have been a lot of misconceptions about the VA Loan – partly due to the minimum property requirements (MPRs) established by the VA. Although educating agents across the country about MPRs has curbed this behavior from listing agents in recent years, these MPRs are probably me and my team’s biggest objections whenever calling a listing agent after a veteran submits an offer on a home utilizing their VA Loan.

In this article, I’m going to dive into the MPRs, so that way agents on both sides of the transaction can continue helping out those who fought for the American Dream.

Hint: this is a long article. Use Ctrl+F to find a specific feature of the MPRs.

What’s the Purpose of the VA’s MPRs?

The VA established the MPRs to protect veterans and make sure they are getting into a home that is habitable. Appraisers, on top of determining the value of a property, are looking for three key things: that the property is safe, structurally sound, and sanitary. On top of that, they are also looking to make sure that the property is free of any legal or zoning concerns.

It’s important to note that a VA Appraisal is not a home inspection. The scope of work for a home inspection and an appraisal are two different things. They also do not prepare appraisals subject to home inspections; they are conducted independently of each other.

Appraisals Do Not Cover Cosmetic Items

Appraisals will not recommend the repair of “cosmetic items, items involving minor deferred maintenance or normal wear and tear, or items that are inconsequential in relation to the overall condition of the property”, but will take that into consideration when determining the value of a home.

Detached Improvements

Detached improvements, such as sheds and ADUs, can be included in the value as long as it meets the MPRs. On a separate note, rental ADU income cannot be counted on a VA loan at all, unlike rental income from a traditional unit on a multi-family purpose. Believe me, I’ve bugged the VA about this multiple times.

More Than One Parcel

Properties with more than one parcel are acceptable as long as the parcels are contiguous (next to each other) and legally marketable. There is no acreage limit set by the VA (though a lender may have an overlay). The appraisal, once completed, will be subject to placing the parcels all onto one deed.

Basic Unit Requirements

Each unit must have sufficient space for living, sleeping, cooking, dining and sanitary facilities. Non-standard houses must meet local building codes.

Easement, Encroachment and Access Rules

Properties must be accessible by walking or with a vehicle, either public or private, with an all weather surface. Private roads must have a permanent easement and either owned by a homeowners association or have a permanent joint maintenance agreement in effect. Access to the easements or backyard must not cross into another property. Encroachments must be fixed and will the appraisal will be issued subject to the repair of the encroachment.

Drainage, Topography and Soil

The property must provide sufficient drainage and prevent pooling/ponding of water on the property. The surface and soil must be in good condition and cannot be considered in a state of subsidence. Although some hairline cracks may be fine, the property’s soil cannot have cracks in the terrain, sinkholes, or foundation problems.

Flood Zones, Coastal Barrier Resources Systems (CBRs) and Lava Flow Hazard Zones

Properties in a FEMA Special Flood Hazard Area (SFHA) must be covered by flood insurance. If the area is ineligible for flood insurance, the property cannot be insured by the VA. Properties that are subject to frequent flooding are also not available either, based on the appraiser’s knowledge of the local area.

If detached structures, such as garages, sheds, etc. are excluded from the property’s value, then flood insurance is not required to insure those detached structures. The policy must still cover the main dwelling. Private flood insurance is acceptable.

Properties in Coastal Barrier Resource Systems (CBRs) are also ineligible for the VA Loan.

Lava Flow Hazard Zones 1 and 2 are also ineligible for the VA Loan.

Non-Residential / Business Use and Zoning

Properties can have residential and business use, but the use of the property must be primarily residential. The business unit cannot affect the residential nature of the home, cannot contain more than one business unit, and is legally permitted. No value can be given to the business operation or commercial fixtures.

The property must also comply with all zoning requirements. However, according to the VA, “if the property does not comply with current zoning ordinances, but is accepted by the local authority, the appraiser must describe the property as ‘Legal Non-Conforming’ and comment on the property’s marketability and any adverse effect this classification may have on value. The appraiser must state whether or not the dwelling may be legally rebuilt if destroyed.”

Utilities

Units must have electricity. Utilities do not have to be turned on when the appraiser visits the property. Damaged or frayed electrical wires must be repaired or replaced. Utilities should be independent for each unit; however, units may share utilities as long as each unit has a separate shut off for each, and utilities shared with other properties must have an easement.

Water Safety and Well Water

Units must have safe and potable water for drinking, bathing, showering and other sanitary uses. It must also have sanitary facilities, hot water and a safe method of sewage disposal.

Well water (an individual water supply) must meet local health quality codes. The veteran must acknowledge that an individual water supply with filters must be constantly maintained and that the failure to maintain the system will lead to a degradation of the quality of potable water.

Shared wells between multiple properties must be capable of providing enough potable water to each property simultaneously, protected by an easement between the properties, and have a well-sharing agreement in place.

Heating

Heating must be installed and able to maintain at least 50 degrees Fahrenheit. Fireplaces are okay. If the property is located in a mild climate, heating may not be required.

Solar Leases and Other Leased Equipment

No value can be given to leased equipment, such as solar panels and propane tanks. Additionally, these lease items may encumber the title for the property.

Roofs and Attics

In addition to preventing moisture from entering the property, the roof must also have “reasonable future utility, durability, and economy of maintenance”. If a defective roof has 3 or more layers of shingles that need to be replaced, all of the old shingles need to be removed.

The appraiser is not required to climb into the attic. However, if there are issues with the attic, the appraisal will be made subject-to the repair of the conditions in the attic.

Crawl Spaces

Just because an area is underneath the property doesn’t necessarily make it a crawl space. The VA’s definition of a crawl space is a space under the structure of the home that includes mechanical fixtures. The crawl space must have adequate access, can’t have debris, and must be properly vented. Floor joists must be able to provide room for maintenance activities. It can’t be excessively damp, and there can’t be any ponding of water.

Basements

Basements can’t be excessively damp, and must not have any obvious structural defects that would take away from the health and safety of the veteran. Sump pumps must be adequately hardwired or connected to an outlet with a suitable receptacle.

Swimming Pools

If the pool contains algae or if the pool is frozen, and the appraiser can’t determine the functionality of the pool equipment, the appraiser will assume under the “extraordinary assumption” that the pool can be repaired at minimal cost and not recommend any repairs. The pool should not have any structural defects. If it does, the appraiser may make the appraisal subject-to the repair of the pool and include the value, or prepare the appraisal subject-to filling in the pool and regrading the yard. The pool must also be secured.

If an above-ground pool has water filtration systems and decking, the appraiser may add that value to the property if it is customary in that real estate market.

Burglar Bar Windows

If a property has burglar bars, at least one window in each bedroom must have a quick release in order to provide a quick egress in the case of an emergency. If the quick releases are not in working order, the appraisal will be made subject-to.

Lead Based Paint

Lead based paint was effectively outlawed in 1978. For houses built in 1978 or later, any defective paint on the outside that exposes the subsurface to the elements must be repaired. Interior defective paint is cosmetic and does not require to be repaired in order to move forward.

In a property built before 1978, the property is presumed to have lead based paint. Any defective paint, whether interior or exterior, has to be fixed. Economic feasibility is highlighted as an unacceptable reason to waiver the repair of said defective paint.

Termites, Fungus, Dry Rot

Appraisers must note any damage from termites or other wood destroying insects, fungus or dry rot. If any damage from these is apparent, the appraisal will be made subject-to a wood destroying insect inspection (termite inspection) and the repair of any damages, should they be found.

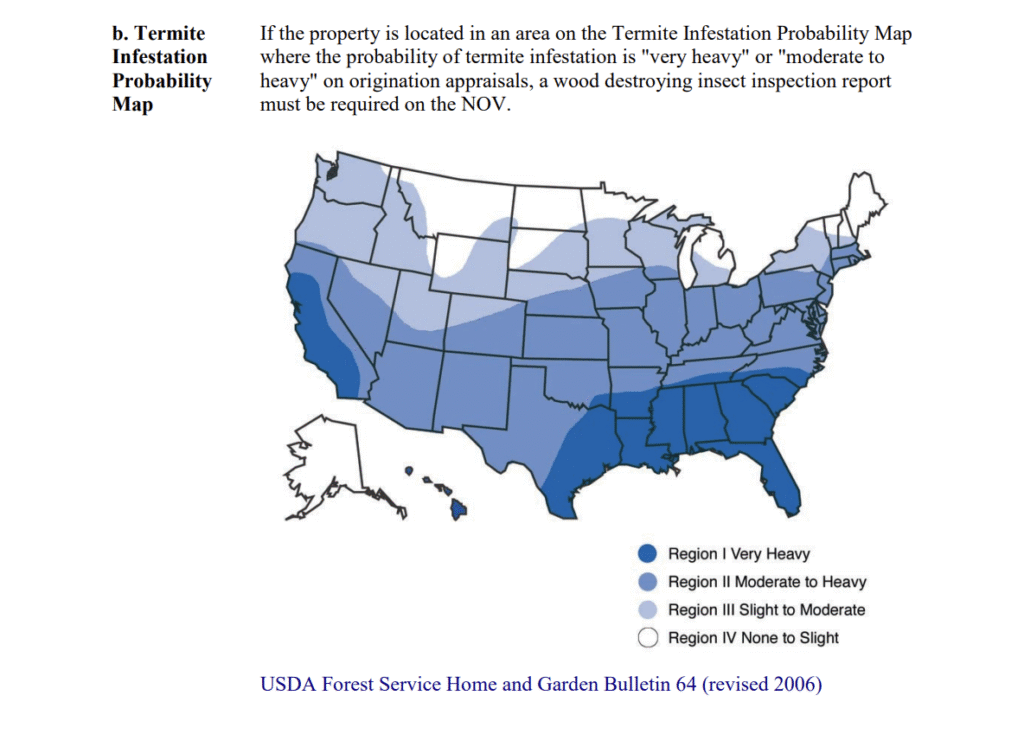

Additionally, in certain areas highlighted below, wood destroying insect inspections may be required on the NOV.

Any parts of the property that were not given value from the appraisal can be excluded from the scope of the wood destroying insect inspection.

Environmental Problems

Potential environmental problems identified by the VA include but are not limited to the following:

- underground storage tanks,

- slush pits,

- oil and gas wells (operating or abandoned),

- hydrogen sulfide gas emitted from petroleum product wells,

- chemical contamination (including methamphetamine) or

- soil contamination from sources on or off the property.

If these problems exist, the appraiser will consider the affect to the value these problems may cause, and the appraisal will be made subject-to the repair of these problems.

Stationary Storage Tanks

Here’s what the VA has to say about stationary storage tanks for fuel:

“If the property is located within 300 feet of an above-ground or subsurface

stationary storage tank with a capacity of 1,000 gallons or more containing

flammable or explosive material, the appraiser must report this information in

the appraisal. This includes storage tanks for domestic and commercial uses

as well as automotive service station tanks.”

The VA requires the veteran’s signed acknowledgement to inform them of the situation.

Closing Thoughts

The VA Loan isn’t just a benefit, it’s a powerful tool that helps those who’ve served our country build wealth through homeownership. Hopefully by reading this article, this will help you understand the VA’s minimum property requirements (MPRs) much better. This article serves to educate buyer’s agents and listing agents alike so that all parties can stay informed, and help veterans keep living the American Dream.

References (in sequential order):

- U.S. Department of Veterans Affairs. (n.d.). Chapter 12: Minimum property requirements. VA Lender’s Handbook (VA Pamphlet 26-7). https://www.benefits.va.gov/WARMS/docs/admin26/m26-07/Ch12_Minimum_Property_Requirement_NEW.pdf