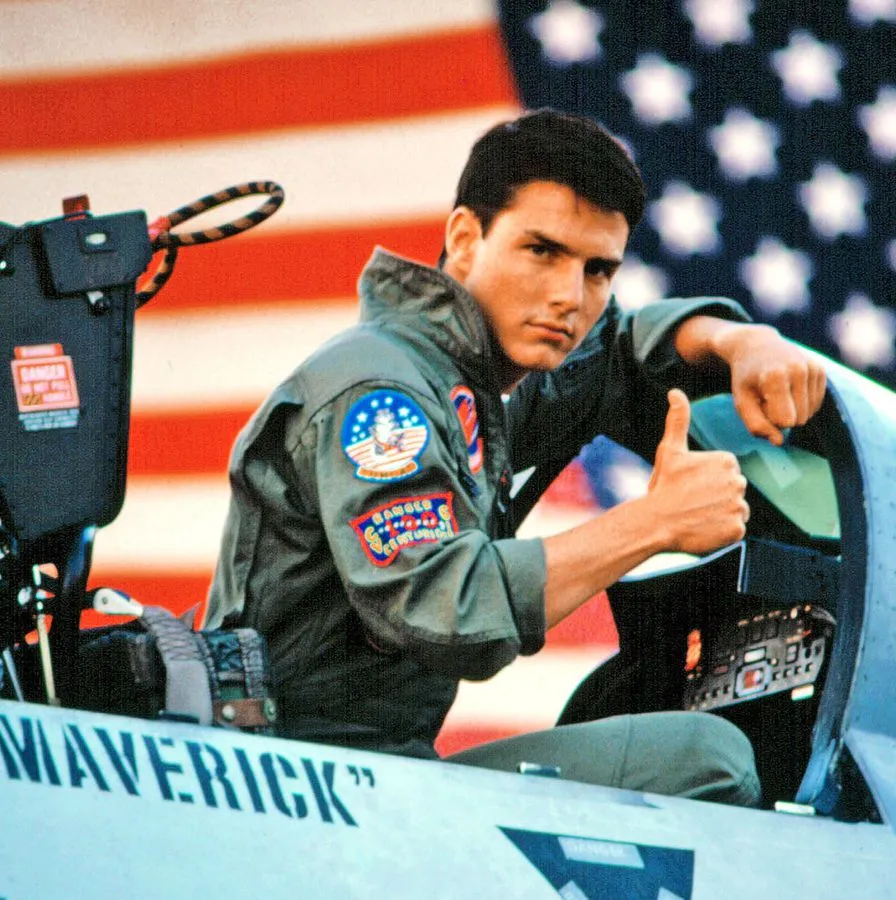

Buying your first home is a major milestone – and as a veteran, you’ve earned one of the most powerful tools available to make that dream a reality: the VA Loan. As a fellow Navy veteran and mortgage lender who specializes in helping servicemembers and veterans navigate the homebuying journey, I understand both the pride and the pressure that come with purchasing your first home. Whether you’re fresh out of the military or finally ready to plant roots after years of service, this guide is here to help you confidently use your VA Loan benefits to their fullest potential – because you fought for the American Dream, and now it’s time to live it.

The VA Loan program is hands down the best loan program out there. The problem is that many veterans and servicemembers don’t even realize they qualify – only 14% of veterans have used their VA Loan. It has a lot more features that other loan programs don’t, and helps make homeownership more accessible and affordable to veterans, who would have higher rates, down payment requirements or otherwise wouldn’t be able to qualify for a mortgage with another loan program.

Here’s are some of the cool things you get to take advantage of with the VA Loan:

No Down Payment Requirements

One of the biggest advantages of the VA Loan is the ability to purchase a home with no down payment requirement; this is a benefit that sets it apart from nearly every other loan program. For first-time homebuyers, especially veterans transitioning to civilian life, saving up for a down payment can be a huge burden. The VA Loan removes that burden and allows qualified veterans and active-duty service members to buy a home with no down payment. You could even buy a $2,000,000 home or more; as long as you financially qualify for it, you can buy it without a down payment. This means you can keep more of your hard-earned savings for moving costs, home improvements, or building an emergency fund – all while becoming a homeowner with zero money down.

If you have a current VA Loan and want to use it again, you likely still have the ability to buy with no down payment, just at a reduced price. This is due to how VA entitlement works, and varies based on purchase price and the county you are purchasing in. For more information, read the next section below.

You Can Use The VA Loan Multiple Times

Many veterans and unfortunately, even some real estate professionals, believe the VA Loan is a one-and-done benefit, but that couldn’t be further from the truth. As long as you have enough entitlement available, you can use your VA Loan benefit again and again. Even if you’ve used it before, it’s possible to restore your entitlement or use any remaining portion to buy another home. And if your new home’s price exceeds the county that you are buying in’s entitlement limits, you’ll only need to cover 25% of the difference – a far more favorable option compared to the dollar-for-dollar down payments required by conventional or FHA loans.

Lower Rates

One of the more appealing benefits of the VA Loan is its consistently lower interest rates compared to conventional mortgages. This is possible because the VA guarantees a portion of the loan, reducing the risk to lenders. Since the VA backs the loan in case of default, lenders are able to offer more competitive rates – which can save veterans tens of thousands of dollars over the life of the loan. It’s one of Uncle Sam’s ways of saying “thank you for your service”.

No Mortgage Insurance

Another standout feature of the VA Loan is that it never requires mortgage insurance, regardless of the down payment amount. Conventional loans typically require private mortgage insurance (PMI) when less than 20% is put down, and FHA loans come with both upfront and monthly mortgage insurance premiums. With the VA Loan, both of these costs are eliminated entirely, which allows veterans to save hundreds of dollars per month and tens of thousands over the life of the loan.

No Minimum Credit Score

Unlike other loan programs, the VA does not set a minimum credit score requirement. Instead, individual lenders create their own guidelines. While many lenders impose stricter credit overlays, I work with veterans from all credit backgrounds. As long as you’ve made on-time payments for the past 12 months, there’s a strong chance I can help you get approved. The VA Loan was designed to offer flexibility and opportunity, especially for those with lower credit scores.

Can Be Used to Buy Up to 4 Units

One of the most powerful, and often overlooked features of the VA Loan is the ability to buy a multi-family property with up to four units with 0% down, as long as you occupy one of them as your primary residence. This allows you to live in one unit and rent out the others, potentially covering your entire mortgage with rental income. Even better, that projected rental income can often be used to help you qualify. It’s an incredible way to build wealth, start investing in real estate, and make the most of your hard-earned VA benefits.

Closing Thoughts

The VA Loan is more than just a mortgage program – it’s a congratulations from the government for fighting for the American Dream. From no down payment and lower short- and long-term costs, to the ability to purchase multi-family properties, the VA Loan is designed to make homeownership more accessible and affordable for veterans and active-duty service members while also giving those with the right strategy unique ways to build their wealth. If you’re a first-time homebuyer, understanding these advantages can help you make smarter financial decisions and build long-term wealth.

As a Navy veteran and mortgage lender, my mission is to ensure you get the most out of your hard-earned benefits. If you’re ready to take the next step toward homeownership, or simply want to explore your options, feel free to reach out to me today. You fought for the American Dream. Now’s your time to start living it too.